Why Arbitrage Funds Are Now A Smarter Choice than Money Market Funds

Money market funds used to be my preferred choice to park idle cash, but recent changes in tax policy have made these funds less appealing. In this post, we explore a more tax-efficient alternative: arbitrage funds.

What are Arbitrage Funds?

Arbitrage Funds are a type of hybrid mutual fund which invest in both equity and debt assets. They use the majority of their assets to generate returns using equity arbitrage trades and invest the remaining in short-term debt vehicles like liquid funds.

What are these arbitage trades? Normally, stock futures trade at a higher price 1 than the underlying stocks. The difference in their prices is based on the cost to borrow money until the futures’ expiry. Arbitrage funds buy shares in the spot market and simultaneously short the corresponding futures, pocketing the difference as profit. Since this trade is risk-free (aka arbitrage), that’s how these funds get their name.

Returns

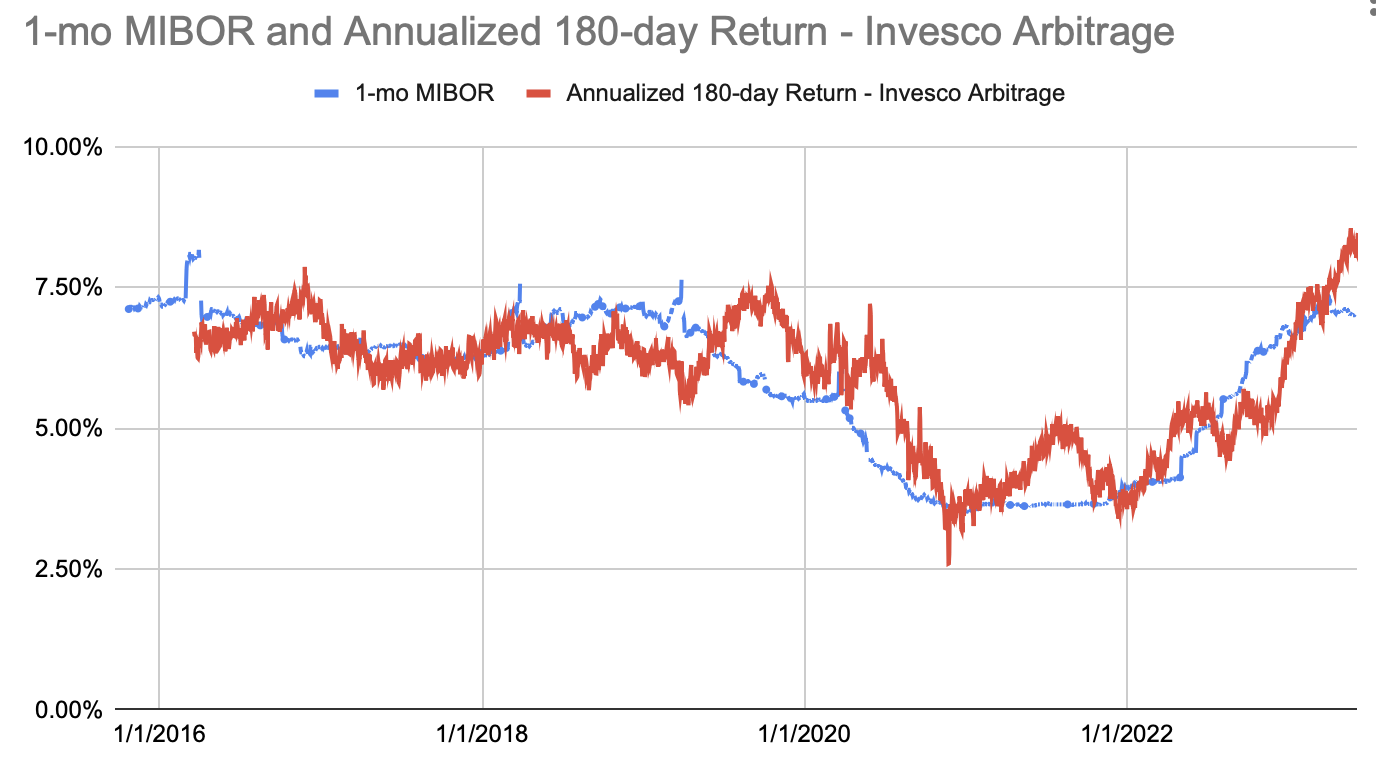

The returns of arbitrage funds are therefore closely tied to the short-term interest rates through which the cost of money is determind. You can see this in the graph comparing the returns to 1-mo MIBOR2.

However, arbitrage funds are not unique in their interest rate-following behaviour. All fixed-income instruments exhibit the same, including Fixed Deposits (FDs), liquid funds, money market funds, ultra-short duration funds etc. The differences lie in the extent of the impact and the speed at which change in rates affects the returns.

Historical Returns

| 1 Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|

| Arbitrage Funds | 6.3% | 5.2% | 4.8% | 5.50% | 6.6% |

| Money Market Funds | 6.8% | 5.2% | 4.8% | 6.2% | 7.2% |

Average CAGR returns of the 25th to 75th percentile funds over each period. Jun’23

Arbitrage funds underperform money market funds by 0.5-0.7% per year.

Risk

The lower returns of arbitrage funds result from them being less risky. SEBI’s Riskometer rates Arbitrage funds as “Low” risk, the lowest rating, compared to “Moderate” risk for money market funds. It is not that money market funds are unsafe but arbitrage funds are even safer.

Tax Treatment

Despite the lower returns, what makes arbitrage funds a superior investment are the much lower taxes. Since arbitrage funds primarily invest in equities and equity derivatives, they are taxed like equity funds: 15% tax on short-term gains and 10% on long-term gains.

Money market funds, on the other hand, are now taxed at one’s income tax slab rate, meaning a 30%+ tax rate for folks in the higher brackets.

Simulated Returns

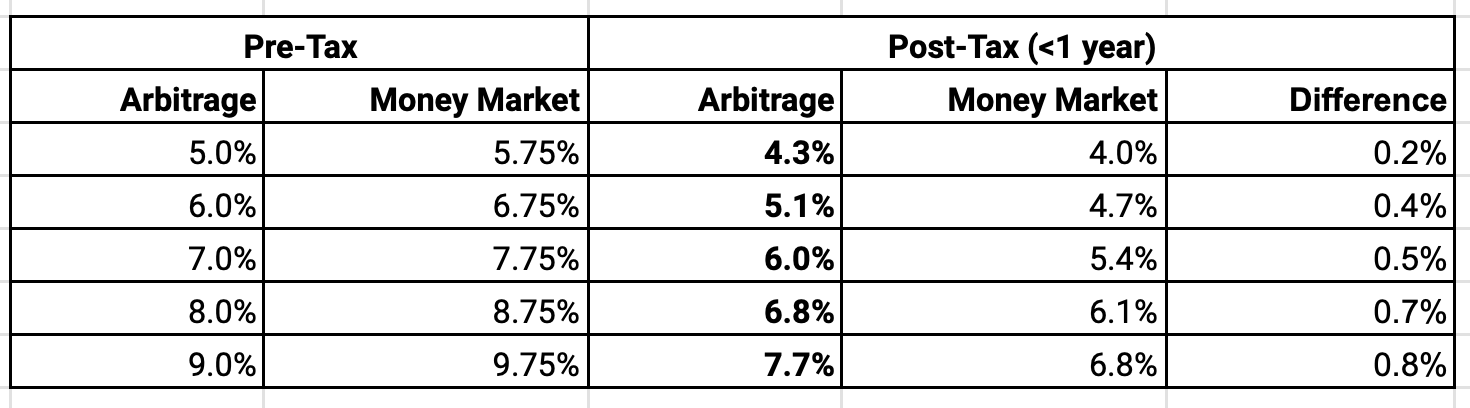

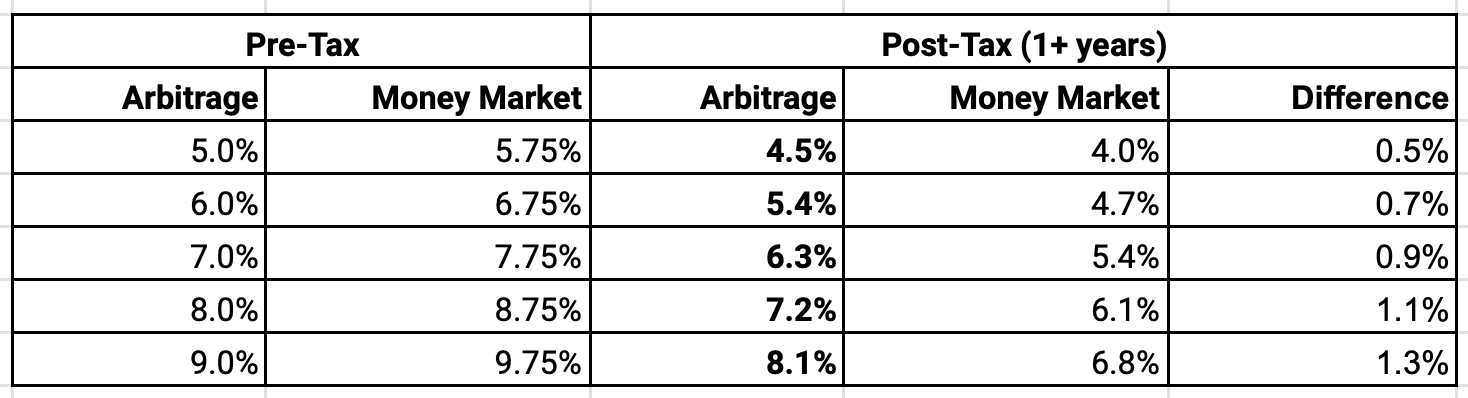

To better understand the tax benefits of arbitrage funds, let’s simulate the post-tax returns of both fund types. To be conservative, let’s assume that money market funds will outperform arbitrage funds by an aggressive 0.75% per annum, compared to the 0.5% historical average.

Assuming a 30% tax rate for money market funds

Although the level of outperformance varies depending on the investment period and the prevailing interest rates, arbitrage funds deliver higher post-tax returns in every scenario.

New tax regulations have made arbitrage funds a better option than money market funds for investors in higher tax brackets. Although these funds generate lower pre-tax returns, they more than make up for it due to favourable tax treatment. Higher returns do not come at the cost of higher risk either. If you are in the 30%+ tax bracket, you should consider arbitrage funds seriously.