Beyond Expense Ratio: Understanding Tracking Error and Tracking Difference

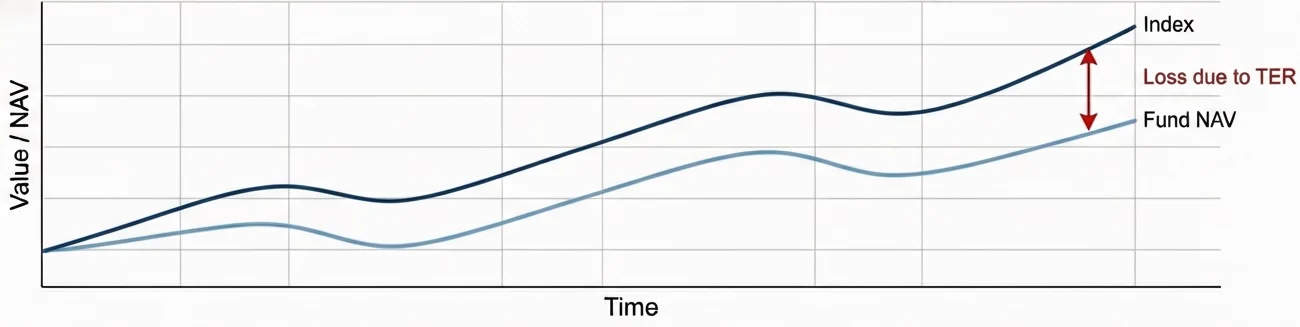

One might expect passive funds to mirror the returns of the index, but in practice, they always underperform. The difference in performance is where three metrics—Expense Ratio, Tracking Error and Tracking Difference—come into play. Some folks suggest picking funds with the lowest expense ratio, or the least tracking error, but the number that actually affects returns is the Tracking Difference (TD).

Total Expense Ratio (TER)

Total Expense Ratio (TER), or simply Expense Ratio, is the fee mutual funds charge for managing your money. It includes management and administrative fees, as well as any commission paid to intermediaries or distributors.

For instance, UTI Nifty 50 Index Fund (Regular) has a TER of 0.33%. Out of this, 0.21% is charged by the UTI, and the remaining 0.12% is paid as commission to your advisor/distributor. If Nifty 50 TRI (Total Return Index) grows 10% in a year, the maximum increase in this fund’s NAV will be 9.67%—before considering any other factors. Therefore, the lower a fund’s expense ratio, the higher your returns. But expense ratio only explains part of the puzzle.

Tracking Difference (TD)

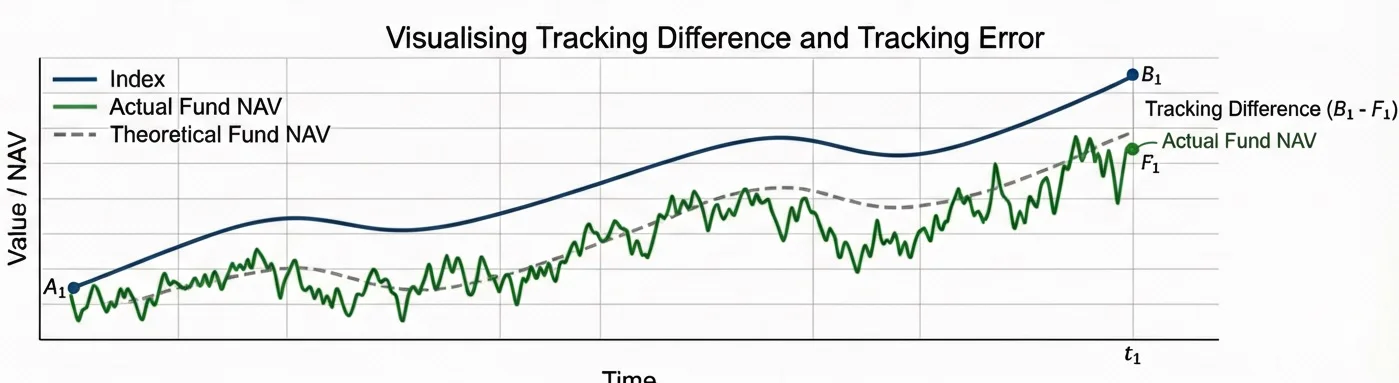

Tracking Difference is the difference between the actual returns of the fund and of the benchmark index, measured over a specific period. For example, if Nifty 50 TRI increases by 12.3% over a one year period and NAV of the fund increases by 12.1%, the tracking difference would be -0.2%. A negative value indicates that the fund has underperformed the index. Ideal tracking difference is zero, but it never is.

| 1 Year Returns | Tracking Difference | |

|---|---|---|

| Nifty 50 TRI | 13.2% | - |

| UTI Nifty 50 Index Fund | 13.0% | -0.2% (=13.0 - 13.2%) |

| HDFC Nifty 50 Index Fund | 12.9% | -0.3% (=12.9 - 13.2%) |

When you compare historical performance of two passive funds tracking the same index, you are indirectly comparing their tracking difference: if Fund A returned 13.0% and Fund B returned 12.9% over the same period, the 0.1% gap is the difference in their Tracking Differences.

TD encompasses all overheads that affect returns, including TER and other frictions like transaction costs, uninvested cash, differences in replication strategy, tax on foreign dividends for international indices etc. Most of the time, Total Expense Ratio is the largest contributor to the Tracking Difference, which is why financial advisors recommend picking low fee funds.

A low TER, however, doesn’t guarantee a low TD. A fund can have a large, persistent Tracking Difference despite having a low expense ratio if it is poorly managed. In such cases, you lose more to underperformance than what you save in fees.

Tracking Difference is quite revealing of a fund’s performance but it is a point-to-point measurement and can vary from one period to another.

Tracking Error (TE)

To analyse how Tracking Difference has varied over time, we have a similar sounding but distinct metric called the Tracking Error (TE). TE is defined as the standard deviation of the fund’s daily tracking difference.

TE helps quantify the variations in TD: a low value indicates minimal fluctuations. For instance, if a fund’s TD bounces between -0.1% and -0.3% frequently, it will have a high TE. If it stays consistently around -0.2%, it will have low TE.

Tracking Error, however, does not indicate anything about the magnitude of the tracking difference—both a consistently high or a consistently low tracking difference result in a low Tracking Error. It only reflects the volatility of the fund’s deviation from the index, not of the fund itself.

Funds should have a low Tracking Error because a high value makes it difficult to predict their future Tracking Difference. The ideal combination is a low Tracking Difference, and a low Tracking Error.

| Low Tracking Error (Consistent) | High Tracking Error (Inconsistent) | |

|---|---|---|

| Low TD (Good Performance) | Ideal: The fund closely and consistently tracks the index. | Unpredictable: Performance is erratic, making future returns uncertain. |

| High TD (Poor Performance) | Consistently Poor: The fund consistently underperforms the index. | Avoid: The fund’s performance is poor and unpredictable. |

Tracking Error and Tracking Difference are backward-looking measurements, unlike TER which is known upfront. Regulators tell us that past returns are not indicative of future performance but the factors that drive Tracking Error and Tracking Difference are often structural and unlikely to change quickly. Therefore, I believe that these metrics should serve as important inputs to our fund selection process.

One can’t predict where the index will go, but we can ensure our chosen fund follows wherever it goes.

Where to find these values?

Since SEBI mandates mutual funds to publicly report these metrics, you can find them in the fund’s factsheet or Key Information Memorandum (KIM), on the respective fund companies’ websites. Always check the official documents since aggregators like ET money, Groww, and Paytm Money may not show nuanced metrics.